Serving economic news and views every morning.

Analysis on the underemployment number in the monthly jobs report.

At least one search term must be present.

At least one search term must be present.

Insight

December 14, 2021

Margaret Barnhorst

Executive Summary

Introduction

The link between health insurance and employment began in response to worker shortages following World War II; to compete for scarce labor following the wage freeze implemented by President Roosevelt, businesses began offering benefits such as health insurance.[1] Employer contributions toward health insurance premiums were exempt from federal payroll taxes and employee contributions were excluded from taxable income. The tax code has remained this way ever since, incentivizing compensation in the form of health insurance and reducing the amount workers owe in income and payroll taxes to the federal government by an estimated $200 billion annually.[2] Many economists have historically been wary of ESI given its skewed tax incentives and the seemingly arbitrary link between health insurance and employment. In particular, some critics contend that ESI hinders job mobility, a phenomenon known as “job lock,” but research has produced inconclusive results for the broader workforce and several studies have found such claims to be overstated.[3], [4]

Despite such criticisms, ESI has remained the most popular type of health insurance in the United States for decades and provides significant value to beneficiaries and taxpayers. In 2021, nearly 156 million Americans were covered by ESI, or about 58 percent of the non-elderly (64 years of age or younger) population.[5] Revealed preference surveys suggest employees value ESI at 75 to 84 percent more than employers and employees together pay for it, and based on estimates from the Congressional Budget Office, taxpayers spend less per-enrollee for ESI compared to Medicaid, subsidized individual market insurance under the Affordable Care Act (ACA), or Medicare.[6],[7] By significantly reducing fiscal pressures on subsidized insurance programs, encouraging work and business formation, and providing comprehensive health care coverage, ESI provides at least $1.5 trillion in net social value annually.[8]

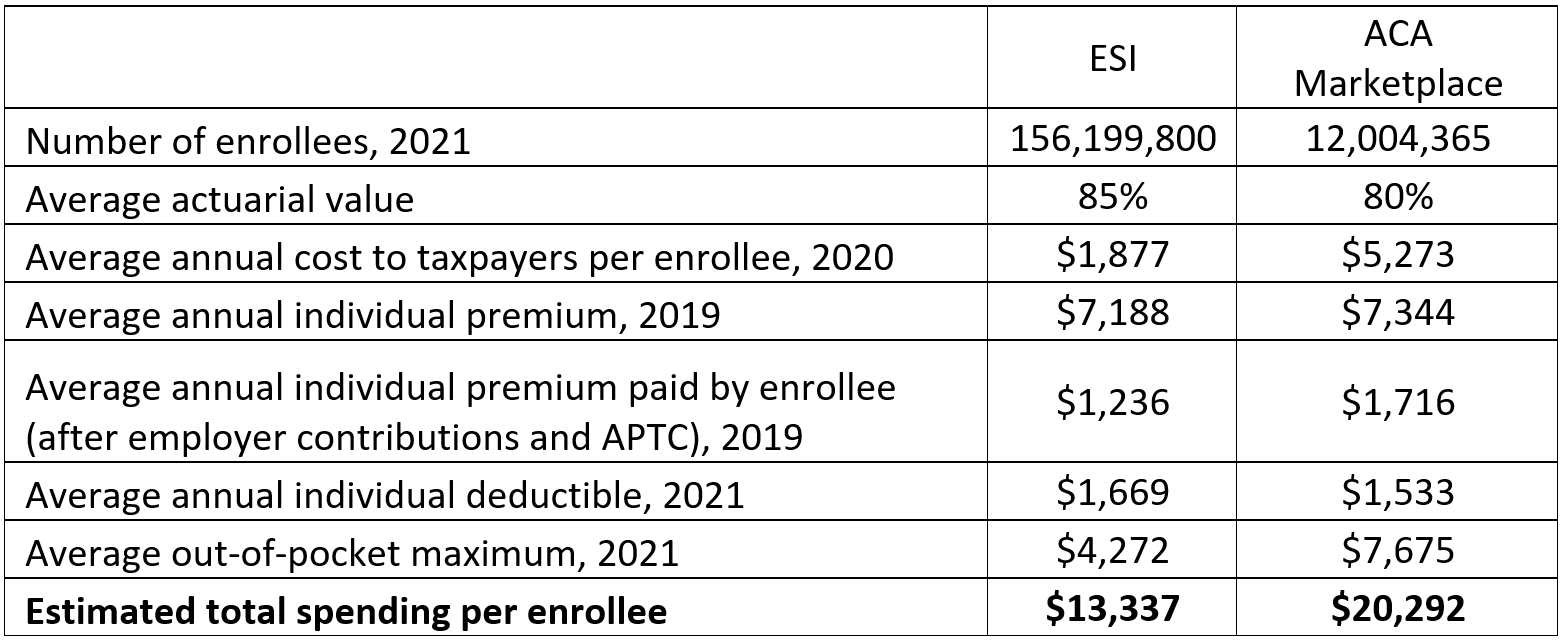

Through group coverage—in which an employer purchases coverage for its employees through an insurer or when multiple employers contract with a single insurer, rather than individual health plans in which individuals purchase their own coverage—ESI plans can efficiently pool risk and extract cost savings for enrollees, leading to lower cost-sharing options, slower premium increases, and more generous benefits relative to plans on ACA exchanges.[9] For example, in 2021, the average deductible for an individual ESI plan is about one-third of the average individual deductible for an ACA Silver plan ($1,669 vs. $4,879), and from 2013 to 2017, average premiums for ESI plans increased 14 percent compared to a 105 percent increase among individual market plans in Healthcare.gov states.[10],[11] Additionally, the average actuarial value of ESI plans, or the percentage of health care costs paid by the health insurance plan, is 85 percent, compared to 70 percent for an ACA Silver plan or 80 percent for a Gold plan.[12] Note: The average actuarial value, average annual individual deductible, and average out-of-pocket maximum for the ACA Marketplace are based on ACA Gold plans as these offer the most similar value to ESI plans. Estimated total spending per enrollee is the sum of federal government spending (average cost to taxpayers), insurer or employer spending (average individual premium), and individual spending (average out-of-pocket maximum).

Note: The average actuarial value, average annual individual deductible, and average out-of-pocket maximum for the ACA Marketplace are based on ACA Gold plans as these offer the most similar value to ESI plans. Estimated total spending per enrollee is the sum of federal government spending (average cost to taxpayers), insurer or employer spending (average individual premium), and individual spending (average out-of-pocket maximum).

Over the past two decades, key metrics of employer plans—such as the annual change in average premiums, the percentage of employers offering coverage, employee eligibility, and the share of employee contributions toward total premiums—have remained relatively stable, even withstanding the effects of the COVID-19 pandemic in the last two years, providing further evidence of the staying power of ESI that the American Action Forum’s Christopher Holt previously described here. Employer plans offer flexible benefits and comprehensive coverage for Americans, and 81 percent of American workers consider health insurance a “must have” benefit.[13] Given the prevalence of ESI in the American health care system, this primer further explores trends in the ESI market and variations in health care access, coverage, costs, and quality across diverse employer plans.

Access

Employers Offering Coverage

The share of employers offering health benefits has remained stable with between 53 to 60 percent of all employers offering health benefits since 2010, and 59 percent in 2021. The ACA requires that employers with 50 or more full-time employees (those who work at least 30 hours per week) either provide full-time employees and their dependents health insurance coverage that meets minimum standards, or pay a penalty to the Internal Revenue Service.[14] In 2021, 99 percent of all large employers (200 or more employees) offer health benefits to at least some of their workers, and 36 percent of these employers extend health benefits to part-time workers.[15]

The ACA does not require employers with fewer than 50 full-time employees to provide health insurance for workers, but in 2021, 56 percent of employers with 3 to 49 workers provide health benefits for at least some of their workers. Among small employers (fewer than 200 workers) offering health benefits, 19 percent extend the offerings to part-time workers in 2021. Among small employers not offering health benefits, the most common reasons they noted for not doing so include that the “cost of health insurance is too high,” “the firm is too small,” “employees are covered by another plan,” and “most employees are part-time or temporary workers.” Employers may also provide funds to their employees to purchase coverage in the individual market, such as through a tax-free Individual Coverage Health Reimbursement Arrangement (ICHRA). In 2021, 7 percent of all firms not offering group health benefits offer such funds to one or more of their employees.[16]

Employers in state and local government and wholesale industries are the most likely to offer health benefits to at least some of their workers in 2021, at 86 percent and 77 percent, respectively, while employers in service and retail industries are the least likely to offer benefits, at 55 percent and 48 percent, respectively.[17]

Types of Plans Offered

Three-quarters of employers that offer health benefits offer only one type of plan, but large employers (59 percent) are more likely than small employers (23 percent) to offer more than one type of plan. Among employers offering health benefits, 26 percent offer at least one preferred provider organization (PPO) plan, 22 percent offer at least one high-deductible health plan with a savings option (HDHP/SO), 13 percent of employers offer at least one point-of-service (POS) plan, 8 percent offer at least one health maintenance organization (HMO) plan, and 1 percent offer at least one conventional plan, which is a plan that has no preferred provider networks and the same cost sharing regardless of physician or hospital.[18]

Plan Funding

When choosing health benefits, employers decide to either contract with an insurance company or self-fund their plan, depending on preferred administrative responsibilities and financial risk.

In the traditional fully insured model, employers purchase coverage for employees through an insurance carrier that assumes financial responsibility for the costs of beneficiaries’ claims. Employers that choose to self-fund their health benefits pay for some or all of the services offered to employees and assume the financial risk of beneficiaries’ claims. Thus, self-funding is more common among large employers compared to small employers given their ability to spread the risk of high costs across a greater number of plan beneficiaries. Self-funded plans are not subject to ACA regulations and offer private employers more flexibility, as the Employee Retirement Income Security Act (ERISA) exempts self-funded plans established by private employers from state insurance laws, such as mandated benefits and consumer protection regulations. As a result, self-funding has grown in popularity over the past two decades: In 2021, 64 percent of all employees are enrolled in a self-funded plan, up from 44 percent in 1999.[19]

In recent years, a complex funding option known as level-funding has also grown in popularity among small employers as it offers the flexibility of a self-funded plan while limiting employer liability for costly medical claims through stop-loss coverage. In 2021, 42 percent of small employers offering health benefits offer a level-funded plan compared to only 13 percent in 2020.[20]

Employee Coverage

Employee Eligibility

An employer can choose to cover any employee who is on the payroll and for whom the employer pays payroll taxes, though employee eligibility requirements vary among employers. As previously mentioned, the ACA requires employers with more than 50 employees to offer minimum essential health coverage to full-time employees and dependents, and employers of all sizes are more likely to offer coverage to full-time employees compared to part-time employees. If an employer offers health coverage to any full-time employee, the employer must offer coverage to all full-time employees, and the same rule applies for part-time employees. Additionally, the ACA requires group plans to extend coverage to adult dependents under the age of 26, and typically, in ESI plans coverage is also offered to the legal spouse of a covered employee.[21]

Among employers offering health benefits in 2021, 81 percent of workers are eligible to enroll, which is the same at small and large employers, and since 1999, consistent with the percentage of between 77 to 82 percent. Driven by differences in eligibility for part-time versus full-time workers, average eligibility rates among employers differ by average wage level at the employer, age distribution of the workforce, and industry; among all workers whose employers offer health benefits, lower-wage workers, younger workers, and retail industry workers have lower than average eligibility rates.[22]

Enrollment

In 2021, 77 percent of all eligible workers participate in their employer’s plan, and this is similar for both small employers (75 percent) and large employers (78 percent). The percentage of workers who take up benefits varies by average wage level at the employer, age distribution of the workforce, and industry, similar to differences in employee eligibility across firms.[23]

While the take-up rate has slightly declined from 85 percent in 1999, the coverage rate has remained stable over the last two decades. In 2021, 62 percent of employees whose employers offer health benefits and 56 percent of all workers are covered by an employer plan. Following trends in employee eligibility and participation, lower-wage workers, younger workers, and workers in the retail and service industries are less likely to be covered by health benefits offered by their employer.[24]

Costs

Premiums

In 2021, the average annual premium for ESI is $7,739 for single coverage and $22,221 for family coverage, both of which increased 4 percent since 2020, consistent with previous yearly increases.[25] Across all firms in 2021, covered workers contribute 17 percent of the premium for single coverage ($1,299 per year) and 28 percent for family coverage ($5,969 per year), while employers cover the remaining amount. Worker contributions toward premiums have been stable since 1999, though they vary among small and large employers. Covered employees at small employers (3 to 199 employees) contribute an average 37 percent of the premium for family coverage ($7,710 per year) while covered employees at large employers (200 or more employees) contribute 24 percent ($5,269 per year).[26]

Covered workers at small employers, however, are much more likely than those at large employers to be in a plan for which the employer pays the full premium: Among covered workers at small employers, 29 percent have no premium for single coverage and 10 percent have no premium for family coverage, compared to 5 percent for single coverage and 1 percent for family coverage at large employers.[27]

Deductibles

Across all ESI plans in 2021, 15 percent of covered workers have no annual deductible. Thus, 85 percent of all covered workers are enrolled in an ESI plan with an annual deductible (an average of $1,669 in 2021), and this percentage is consistent across employers of all sizes. Again, however, this varies by employer size: Among workers with a deductible, the average amount for those at small employers is $2,379 versus $1,397 for those at large employers. The likelihood of having an annual deductible also varies among plan types: In 2021, 43 percent of covered workers in HMOs have no deductible, compared to 15 percent of those in PPOs, and 15 percent of those in POS plans.[28]

Out-of-pocket (OOP) Maximums

The ACA requires that most non-grandfathered plans[29] have an OOP maximum of no more than $8,550 for single coverage or $17,100 for family coverage in 2021 (the limits are slightly lower for HDHP/SOs), and therefore, more than 99 percent of covered workers are in a plan with an OOP maximum for single coverage. Among these workers, the average OOP maximum amount is $4,272, though 13 percent have a maximum less than $1,999 and 27 percent have a maximum higher than $6,000.[30]

Other Cost-sharing

In addition to annual deductibles that may apply, covered workers may have coinsurance, copayments, or per-day charges for hospital admissions, surgery, or physician visits. Roughly two-thirds (68 percent) of covered workers have a coinsurance that applies to inpatient hospital admissions and outpatient surgery, more common than the share of covered workers responsible for copayments (12 percent for hospital admissions and 16 percent for outpatient surgery) or per-day charges (9 percent for hospital admissions). For both hospital admission and outpatient surgery, 15 percent of covered workers have no additional cost-sharing after their deductible is met.[31]

In contrast, the most common form of cost-sharing for physician’s visits is a copayment: 71 percent of covered workers are responsible for a copayment for primary care physician office visits and 69 percent have a copayment for specialty physician visits. Among covered workers in ESI plans, the average copayment is $25 for in-network primary care physicians and $42 for in-network specialty physicians.[32]

Quality of Care

Benefits Offered

The ACA requires employers with more than 50 employees to offer minimum essential coverage to full-time employees, which includes having an actuarial value greater than 60 percent and covering 10 “essential health benefits.” ESI plans offer more generous and comprehensive coverage than most ACA plans, with an average actuarial value of 85 percent—higher than that of Bronze (60 percent), Silver (70 percent), and Gold plans (80 percent) on the ACA exchanges.[33] Almost all workers (99 percent) are at an employer that offers prescription drug coverage in its largest plan, and 92 percent are in a plan with tiered cost sharing for various drug classes.[34]

Employer plans played a key role in helping sustain coverage throughout the COVID-19 pandemic, in part because many employers continued to provide premium support to furloughed or laid off workers, and many employers updated benefits to accommodate changes in worker preferences.[35] In 2021, 95 percent of employers that offer health benefits with more than 50 workers cover health care services through telemedicine, up from 85 percent in 2020 and much higher than 31 percent in 2015. Notably, among employers offering telemedicine benefits, 65 percent made changes during the pandemic, including increased promotion of telehealth resources, expanded coverage for additional modes of telemedicine, and expanded coverage for locations where enrollees may use telemedicine services.[36]

The effects of the pandemic also encouraged employers to expand services intended to address mental health and substance use disorders; among employers offering health benefits with at least 50 employees, 39 percent made changes to mental health and substance abuse coverage since the COVID-19 pandemic began, such as implementing employee assistance programs or waiving or reducing cost-sharing for related services.[37]

Worker Wellness Programs

To promote a healthy workforce, employers are incentivized to identify health issues and manage chronic conditions to promote overall wellbeing among employees and increase worker engagement. In addition to traditional health benefits, many ESI plans offer wellness initiatives tailored to meet the needs of employees and their families.

Among employers offering health benefits in 2021, 59 percent offer a wellness program for enrollees, ranging from 83 percent of large employers to 58 percent of small employers. Such wellness programs include lifestyle or behavioral coaching (offered by 49 percent of employers offering health benefits) and those to help workers lose weight (45 percent) or stop smoking (43 percent). Other common wellness initiatives offered by employer plans include biometric screenings to measure risk factors for medical conditions and health promotion programs to encourage employees to engage in healthy lifestyles. As with telemedicine and mental health services, the majority of employers responded to the COVID-19 pandemic by updating wellness programs and health promotion activities to address changing employee needs.[38]

Research suggests that employee health, well-being, and engagement at work are all intertwined, and in a 2019 survey, 83 percent of employers said they believed their company’s wellness program had a positive impact on workers’ health, while 84 percent said they believed such programs had a positive impact on productivity and performance.[39], [40] In a similar survey in 2021, 79 percent of employees said they believe well-being programs offered by their employer maximize productivity and 79 percent said they believe they help avoid sickness.[41] There is relatively limited data on the effectiveness of employer wellness programs given that many employers who offer such programs do not measure results, though some studies indicate that improving employee health and engagement through wellness programs could help reduce health care and overall costs for employers through reduced emergency room visits and hospital admissions and reduced absenteeism of workers.[42]

Employee Satisfaction

Surveys continue to find that the majority of ESI enrollees are highly satisfied with their employer plans and place great value on health benefits when considering job opportunities.[43], [44] In a March 2021 survey from America’s Health Insurance Plans, two-thirds of ESI enrollees were satisfied with their coverage, 76 percent were confident they will be protected in a medical emergency, and 71 percent said their coverage was easy to use and understand.[45] Additionally, 75 percent of respondents said that health insurance was a factor in their decision to accept their current job and 78 percent said it impacted their decision to stay at their current job.[46] Based on a 2015 Glassdoor survey, nearly 4 out of 5 American workers rather receive an upgrade in their benefit package than an increase in pay, with health insurance being the most valued benefit.[47]

Conclusion

ESI is the dominant form of health coverage in the United States and is overwhelmingly popular among enrollees. While plan offerings differ among employers and industries, employer plans overall offer more comprehensive coverage and better-quality care by several measures compared to public alternatives. Throughout the economic and health care disruptions caused by the COVID-19 pandemic, employers expanded benefit offerings to address employee wellness and mental health without drastically increasing costs, and played a key role in sustaining health care coverage, further demonstrating the importance of ESI in the American health care system.

[1] https://www.nytimes.com/2017/09/05/upshot/the-real-reason-the-us-has-employer-sponsored-health-insurance.html

[2] https://www.nber.org/system/files/working_papers/w28590/w28590.pdf

[3] https://www.heritage.org/health-care-reform/report/does-employer-sponsored-health-insurance-reduce-job-mobility

[4] https://www.levyinstitute.org/pubs/ppb10.pdf

[5] https://www.ehealthinsurance.com/resources/small-business/how-many-americans-get-health-insurance-from-their-employer

[6] https://www.nber.org/system/files/working_papers/w28590/w28590.pdf

[7] https://www.cbo.gov/system/files/2020-09/56571-federal-health-subsidies.pdf

[8] https://www.nber.org/system/files/working_papers/w28590/w28590.pdf

[9] https://republicans-edlabor.house.gov/uploadedfiles/esi_letter_-_final.pdf

[10] https://www.cms.gov/CCIIO/Resources/Data-Resources/Downloads/2021QHPPremiumsChoiceReport.pdf

[11] https://aspe.hhs.gov/sites/default/files/private/pdf/256751/IndividualMarketPremiumChanges.pdf

[12] https://www.dol.gov/sites/dolgov/files/ebsa/researchers/analysis/health-and-welfare/analysis-of-actuarial-values-and-plan-funding-using-plans-from-the-national-compensation-survey.pdf

[13] https://www.metlife.com/employee-benefit-trends/ebts-thriving-in-new-work-world-2019/

[14] https://www.irs.gov/affordable-care-act/employers/employer-shared-responsibility-provisions

[15] https://www.kff.org/report-section/ehbs-2021-section-2-health-benefits-offer-rates/

[16] https://www.kff.org/report-section/ehbs-2021-section-2-health-benefits-offer-rates/

[17] https://www.kff.org/report-section/ehbs-2021-section-2-health-benefits-offer-rates/

[18] https://www.kff.org/report-section/ehbs-2021-section-4-types-of-plans-offered/

[19] https://www.kff.org/report-section/ehbs-2021-section-10-plan-funding/

[20] https://www.kff.org/report-section/ehbs-2021-section-10-plan-funding/

[21] https://healthcoverageguide.org/reference-guide/eligibility-and-enrollment/eligible-employees-and-dependents/#top

[22] https://www.kff.org/report-section/ehbs-2021-section-3-employee-coverage-eligibility-and-participation/

[23] https://www.kff.org/report-section/ehbs-2021-section-3-employee-coverage-eligibility-and-participation/

[24] https://www.kff.org/report-section/ehbs-2021-section-3-employee-coverage-eligibility-and-participation/

[25] https://www.kff.org/report-section/ehbs-2021-section-1-cost-of-health-insurance/

[26] https://www.kff.org/report-section/ehbs-2021-section-6-worker-and-employer-contributions-for-premiums/

[27] https://www.kff.org/report-section/ehbs-2021-section-6-worker-and-employer-contributions-for-premiums/

[28] https://www.kff.org/report-section/ehbs-2021-section-7-employee-cost-sharing/

[29] Based on the 2020 Kaiser Family Foundation Employer Health Benefits Survey, 16% of firms offering health benefits offer at least one grandfathered health plan, and 14% of covered workers are enrolled in a grandfathered plan.

[30] https://www.kff.org/report-section/ehbs-2021-section-7-employee-cost-sharing/

[31] https://www.kff.org/report-section/ehbs-2021-section-7-employee-cost-sharing/

[32] https://www.kff.org/report-section/ehbs-2021-section-7-employee-cost-sharing/

[33] https://www.dol.gov/sites/dolgov/files/ebsa/researchers/analysis/health-and-welfare/analysis-of-actuarial-values-and-plan-funding-using-plans-from-the-national-compensation-survey.pdf

[34] https://www.kff.org/report-section/ehbs-2021-section-9-prescription-drug-benefits/

[35] https://www.bls.gov/brs/2020-results.htm

[36] https://www.kff.org/report-section/ehbs-2021-section-13-employer-practices-telehealth-and-employer-responses-to-the-pandemic/

[37] https://www.kff.org/report-section/ehbs-2021-section-13-employer-practices-telehealth-and-employer-responses-to-the-pandemic/

[38] https://www.kff.org/report-section/ehbs-2021-section-12-health-screening-and-health-promotion-and-wellness-programs/

[39] https://hbr.org/resources/pdfs/comm/achievers/hbr_achievers_report_sep13.pdf

[40] https://www.statista.com/statistics/731721/impact-on-workers-from-company-offered-wellness-programs-in-us/

[41] https://www.statista.com/statistics/1058121/us-employees-opinions-towards-employee-wellbeing-programs/

[42] https://docushare-web.apps.external.pioneer.humana.com/Marketing/docushare-app?file=2853084

[43] https://www.kff.org/report-section/kaiser-family-foundation-la-times-survey-of-adults-with-employer-sponsored-insurance-executive-summary/

[44] https://www.ebri.org/docs/default-source/wbs/wws-2021/2021-workplace-wellness-short-report.pdf

[45] https://www.ahip.org/new-survey-employer-provided-health-coverage-is-delivering-real-value-for-consumers-during-the-pandemic/

[46] https://www.ahip.org/new-survey-employer-provided-health-coverage-is-delivering-real-value-for-consumers-during-the-pandemic/

[47] https://www.glassdoor.com/blog/ecs-q3-2015/

Disclaimer

Margaret (Meg) Barnhorst is a Health Care Policy Fellow at the American Action Forum.

December 15, 2021

Insight

Ewelina Czapla

Executive Summary The Department of Energy’s Loan Programs Office offers loans for energy projects in an effort to commercialize novel technologies. …

December 14, 2021

Insight

Isabel Soto, Ewelina Czapla

Executive Summary As part of President Biden’s climate change mitigation strategy, the Build Back Better Act (BBBA) includes tax credits for…

December 13, 2021

Insight

Dan Bosch

EXECUTIVE SUMMARY The Biden Administration recently unveiled its second regulatory agenda, which provides a list of regulatory actions that the administration…

December 13, 2021

Insight

Gordon Gray

…

Margaret (Meg) Barnhorst is a Health Care Policy Fellow at the American Action Forum.

Privacy Policy

The American Action Forum is a 21st century center-right policy institute providing actionable research and analysis to solve America’s most pressing policy challenges.

COVID-19

Surviving The 2nd Wave of Corona

‘This too shall pass away’ this famous Persian adage seems to be defeating us again and again in the case of COVID-19. Despite every effort